will capital gains tax increase in 2021

The proposal would increase the maximum stated capital gain rate from 20 to 25. Last years tax gains.

Real Estate Capital Gains Tax Rates In 2021 2022

November 4 2022 214 AM 2 min read.

. Weve got all the 2021 and 2022 capital gains tax rates in one. 22 hours agoOne option on the table is an increase in the headline rate of capital gains tax applied on profits of the sale or disposal of shares and other property as well as changes to. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

19 hours agoThats about 15 of all UK tax receipts. The tax hike would apply to households making more than 1 million. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. The Chancellor is looking at raising taxes on the sale of. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

The effective date for this increase would be September 13 2021. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Not only would President Bidens plan increase the capital gains tax rate from 20 to 37 or 396 if the proposal to increase the top individual income tax rate is.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole.

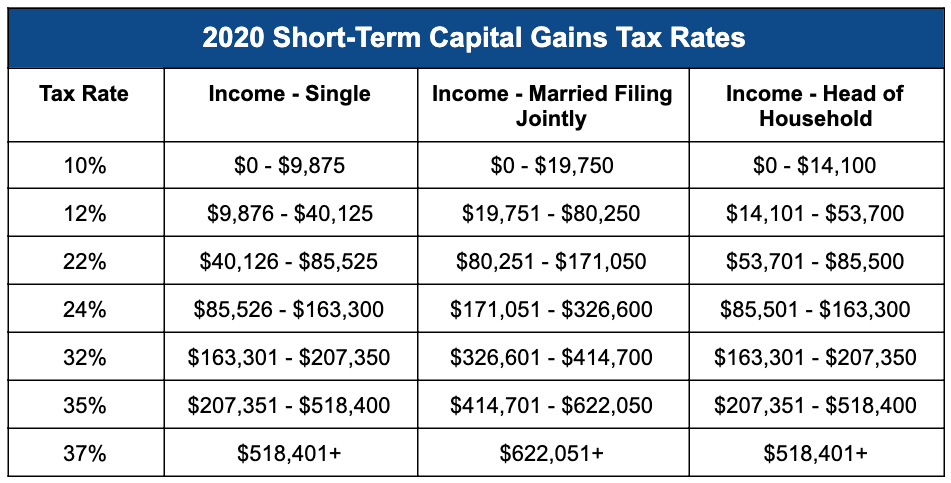

Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. By Charlie Bradley 0700 Thu Oct 28 2021.

Note that short-term capital gains taxes are even higher. Its the gain you make thats taxed. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Those tax rates for long. However it was struck down in March 2022. According to the UK Government CGT is a tax on the profit when you sell or dispose of something an asset thats increased in value.

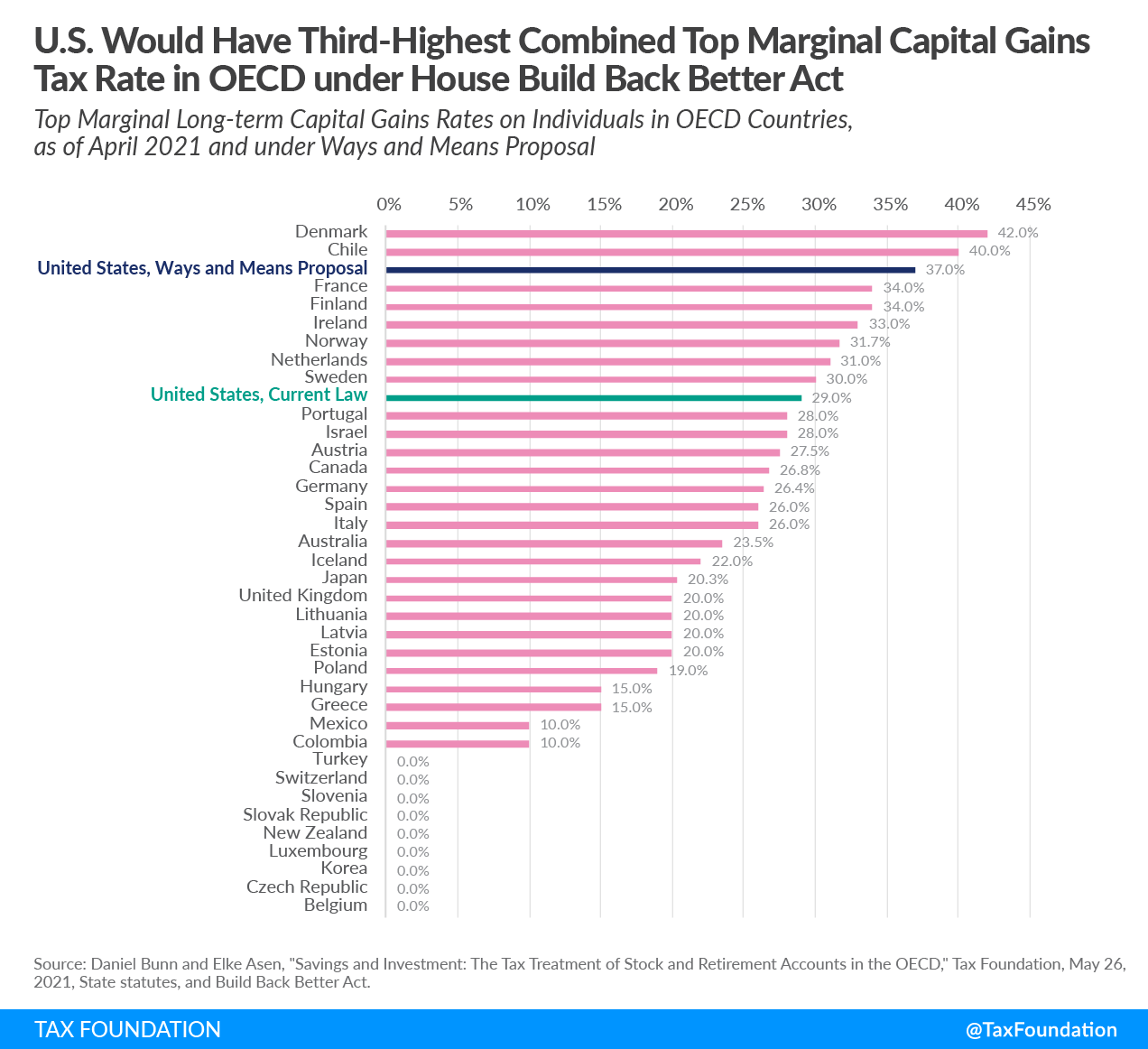

Increasing the federal capital gains rate to 434 for taxpayers with adjusted gross income over 1 million. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate. Biden is set to propose a sharp increase in capital gains tax to 396 from the current 20 level for those making more than 1 million a year according to reports in the New.

Biden Administration Looking At 43 4 Capital Gain Tax Rate Insurance Business America

Income Tax And Capital Gains Rates 2021 03 01 21 Skloff Financial Group

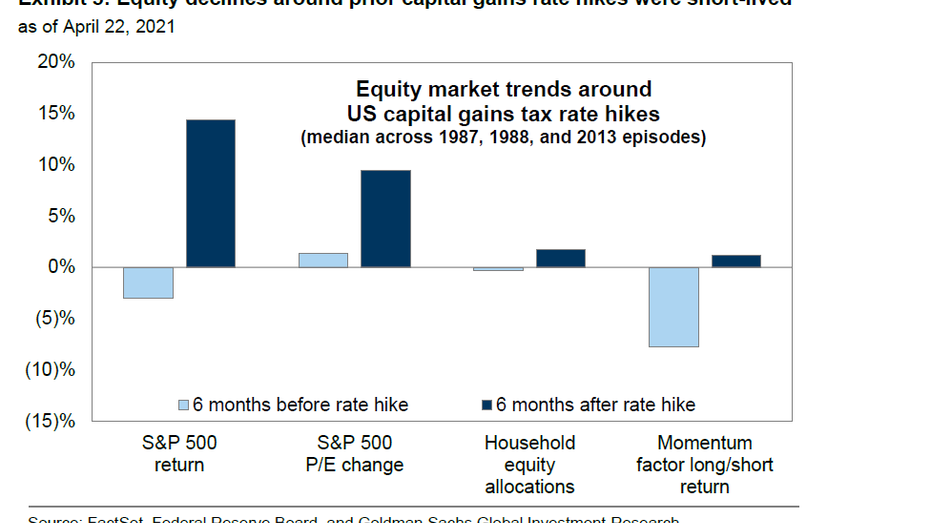

Capital Gains Tax Hikes And Stock Market Performance Fox Business

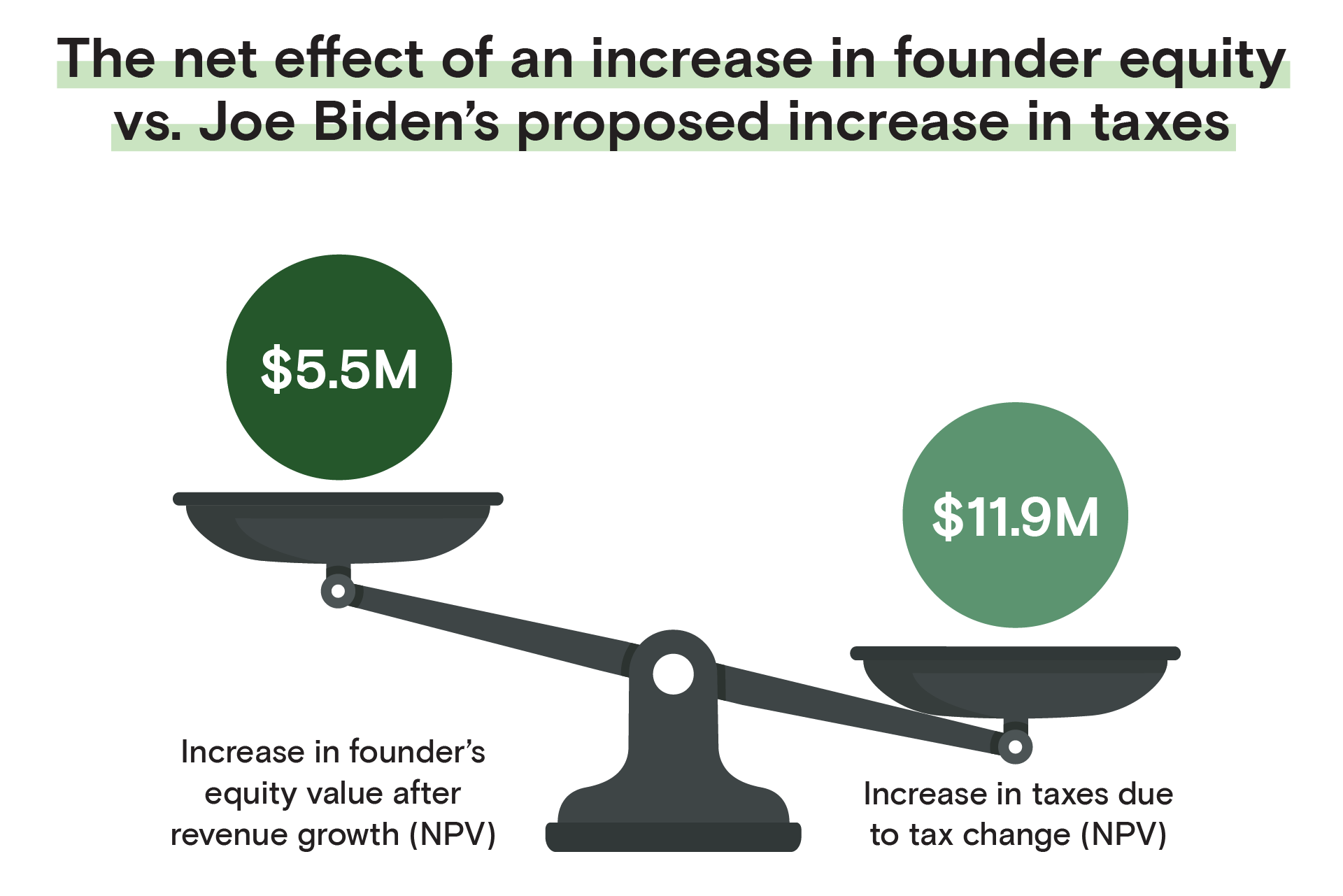

For Founders The Implications Of Joe Biden S Proposed Tax Code

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Analyzing Biden S New American Families Plan Tax Proposal

Managing Tax Rate Uncertainty Russell Investments

The Us Would Have The Third Highest Combined Top Marginal Capital Gains Tax Rate Among Oced Countries Topforeignstocks Com

What You Need To Know About Capital Gains Tax

New Tax Initiatives Could Be Unveiled Commerce Trust Company

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

Capital Gains Nonsense Econlib

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Long Term Capital Gains Tax Rates In 2021 Darrow Wealth Management

Short Term And Long Term Capital Gains Tax Rates By Income

Why Biden S Plan To Raise Taxes For Rich Investors Isn T Hurting Stocks The New York Times

Capital Gains Trade Nears Potential Deadline As Legislation Looms